County and State Services

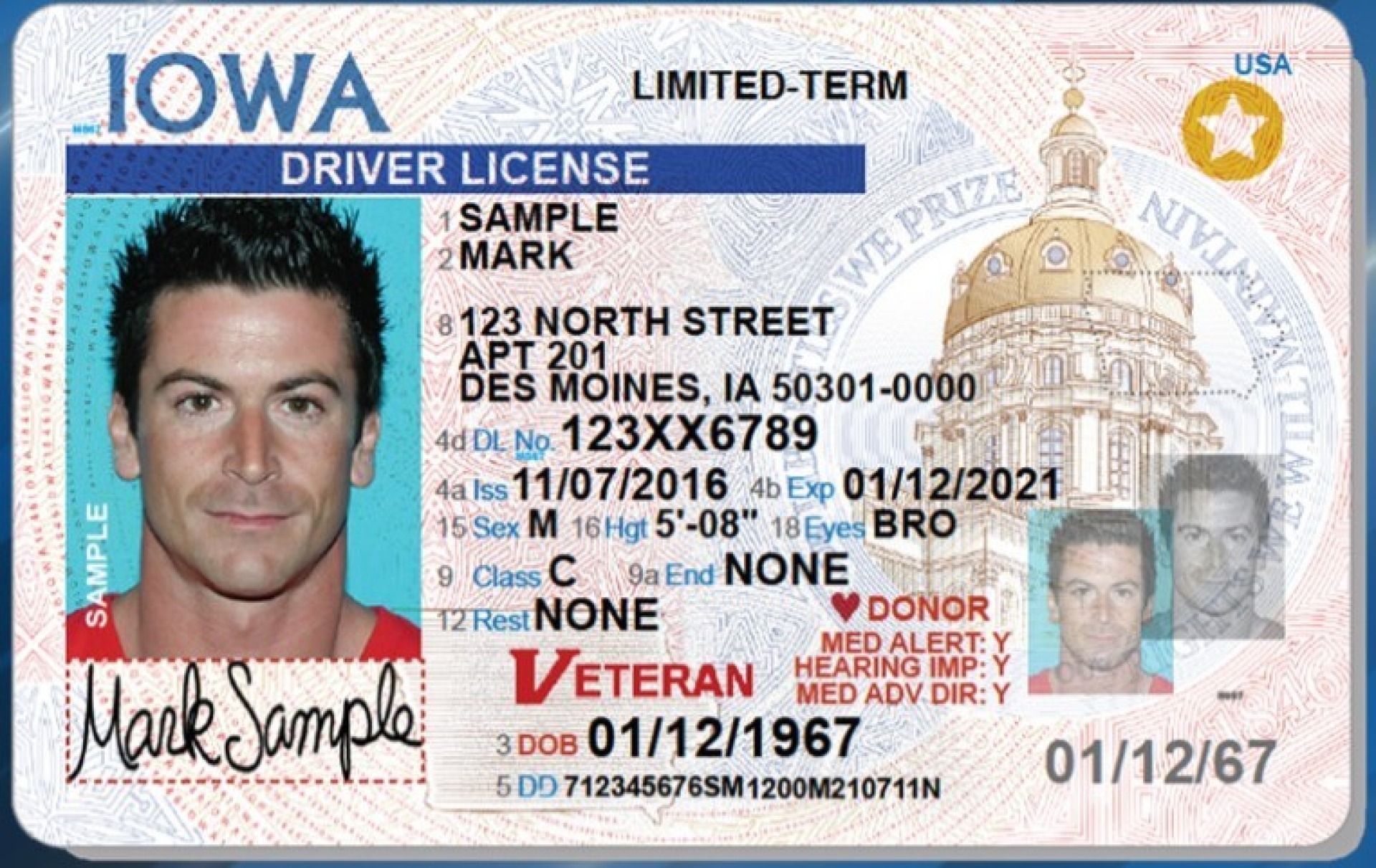

Veteran Drivers License

If you are an honorably discharged Veteran, getting a Veteran designation on your Iowa driving license is a simple process. Please bring your current driver's license and your member 4 DD214 to our office. We will complete Iowa DOT form 432035 and verify your DD214 information makes you eligible. You will then need to take the form to the Courthouse and go to where you would usually pick up your driver's license and they will take it from there.

Veteran License Plates

If you are an Honorably discharged or retired Veteran you are eligible to have special license plates for your vehicle. This is also available to National Guard members if they meet certain requirements of federal service. There are several different options depending on medal earned for discharged veterans and branch of service for retired veterans. If you are interested, please come to our office with your member 4 DD214 and your current Iowa license plate number and we can take care of the paperwork. There is no fee for your first plate (unless you personalize it) and the plate will be sent to the Courthouse for pick up once it has been made.

Veteran Hunting and Fishing License

If you are a service-connected Iowa based veteran you can get a lifetime Hunting and fishing license for $7. You must have your member 4 DD214 showing honorable service and will need a recent benefits summary letter from the federal VA showing that you have a service-connected disability.

Military Service Tax Exemption

Any honorably discharged veteran who served at least 18 months of active duty, less than 18 months but was discharged due to a service-related injury or served during an eligible service period (see form for more details), member or former member of the Reserve Forces or Iowa National Guard who served at least 20 years or was activated for federal duty (not including training) for a minimum of 90 days, or any of the following relatives of a qualified veteran:

- Spouse

- Unmarried Widow/Widower

- Minor Child

- Widowed Parent

Please note, in order to qualify for the exemption, you must have your DD-214 recorded in Cerro Gordo County.

100% Permanent and total disability tax exemption

Qualifying individuals are veterans with 100% service-related disability status or a permanent total disability rating based on individual unemployability paid at the 100% disability rate, or a surviving spouse or child receiving dependency and indemnity compensation (DIC). The applicant must own and occupy the property on July 1st of each year, declare residency in Iowa for income tax purposes, and occupy the property at least six months each year.

Finding a Veteran's Records

If a Veteran or loved one cannot find your discharge papers or military records, please come to us for assistance. We will need as much information as possible to be able to find the records so please make sure you have the following information:

- The Veterans name, DoB and SSN

- The Veterans branch of service and (approximate) dates of service.

If you are acting on behalf of a veteran, or if the veteran has passed, we will need to see proof confirming this before any information or documents can be handed over.

Adding Dependants/Change in Circumstances

If you are a Veteran receiving a monthly check from the Federal VA, then you need to ensure that you update your records so you are getting the right amount each month. To add a dependent, complete a VA 21-686c at the Cerro Gordo County Veteran Affairs Office, or submit the form using EBenefits online.