Frequently Asked Questions

Filter by Department

Attorney Auditor County Assessor Engineer and Secondary Roads Planning and Zoning Recorder Sheriff Treasurer Veteran Affairs Show AllAttorney

Unless you receive a subpoena, you need not talk to a defense attorney, the Defendant, or anyone else connected with the defense. It's all right to ask for identification before you agree to talk to anyone. If the defense wants your statement, they can subpoena you for a deposition (a formal sworn statement) at which the County Attorney will be present. If the Defendant requires a written statement, call your County Attorney.

If you change address or phone number, contact the Sheriff or Police Department investigating your case. If the county Attorney filed a charge, notify that office. If you have been subpoenaed, call the County Attorney's Office before you go to Court to make sure you don't make an unnecessary trip. Court cases are often rescheduled for a variety of reasons.

Knowingly making false statement of material fact of falsely denying knowledge of a material fact is perjury, a felony. If you are aware of possible perjury, contact the appropriate enforcement agency or your County Attorney's Office immediately.

Almost all Defendants are released prior to trial. To ensure the safety of others and the appearance of the Defendant at trial, release is subject to conditions imposed by the court. The conditions may include posting money (bail), hours, travel restrictions, and others. Your County Attorney may ask the court to amend the conditions if necessary.

If you have had property stolen, report it to the nearest law enforcement agency and your insurance company immediately. If it is recovered it may be held for evidence. If you have a real need for your property, call the Department that has your property or the County Attorney. In some cases, you may have to file a claim with the Clerk of Court to get your property back. Usually evidence is returned after the completion of sentencing.

The Court may order convicted Defendants to pay restitution to victims. In case of violent crime, you may also file a claim for reparations with the State. Ask your prosecutor about the program.

There are a variety of special services provided for persons who are victims or witnesses. They include such varied things as reparations, day care, parking, counseling, and others. You may contact your local prosecutor, your local Department of Human Services or a local law enforcement agency if you need assistance in identifying or contacting providers of these service. Services vary greatly from county to county.

Witnesses must appear and truthfully testify under oath when subpoenaed. A subpoena indicates where you should be and when. The prosecutor may ask you to report to the office of the County Attorney first. Bring your subpoena along with you so that you may claim your witness and mileage fees after you testify.

If you have any questions about your testimony, call your County Attorney.

On rare occasions, witnesses are threatened or harassed. Tampering with witnesses and harassment are crimes. If this happens, contact the appropriate law enforcement department and your County Attorney.

Witnesses are entitled to $10 for each full day attendance and $5 for each attendance less than full day, plus an allowance for each mile you traveled. In most counties, take your subpoena to the Clerk of Court to claim your fees. If otherwise, your County Attorney will help you.

When you receive a subpoena, check with your employer to find out what the company policy is regarding your appearances in Court both before trial and at trial. Policies vary widely and can depend on different circumstances. If you would like, your prosecutor handling the case can call your employer or provide a letter, which will explain the need for your appearance.

Auditor

Absentee

No. In Iowa you can only request an absentee ballot for yourself.

Yes. You may request an absentee ballot via email or fax and a ballot will be mailed to you. However, in order for your ballot to be counted you must also mail in or drop off the original paper ballot request.

No. Under Iowa law, power of attorney does not apply for all election related matters.

The only people who may return a ballot for a voter are:

- someone living in the voter’s household

- an immediate family member

- a special precinct election official delivering a ballot for health care residents

- a delivery agent, in the case of a voter unable to return a ballot due to blindness or other disability

Yes! Your absentee ballot cannot be counted unless you have signed the affidavit envelope that you return your ballot in. If we receive a ballot back that has not been signed we will attempt to contact you to get this fixed. Once contacted, you may decide to either:

- Request a replacement ballot and return it by 8:00 p.m. on election day

- Vote at the polls on election day

- Sign the affidavit in person at the county auditor’s office by 8:00 p.m. on election day

Yes. There is a myth that absentee ballots only get counted if the election is close, however, this is not true. Under Iowa law, every ballot must be counted.

Iowa law authorizes additional voter registration and absentee voting rights for Iowans actively serving in the military or living outside the United States.

For local questions or personal assistance, contact:

Alexis Jackson, Deputy Auditor

641-421-3041

A college student may register at the student's "permanent" home address or at the college residence, but not both. Your son or daughter must complete and sign an Absentee Ballot Request and deliver/mail it to the appropriate County Auditor.

Call the County Auditor's office at 641-421-3041 or visit the absentee voting section of this website. Mail or drop off your completed form at the County Auditor's office. Once the form is received, a ballot will be mailed to you.

No. Results from absentee voting are not released until after the polls close on Election Day. Prior to that, the media sometimes speculates on voting results based on the number of absentee voters and those voters' political party affiliations.

To request a replacement ballot:

- Contact the County Auditor's office at 641-421-3041 and advise them of the situation.

- You will be asked to complete and sign a form stating that you lost or never received the absentee ballot.

- Ask for a replacement absentee ballot.

You are allowed to hand deliver your ballot to the Auditor’s office up until the time the polls close on Election Day. If you return your ballot through the mail, your ballot must arrive by 8:00 p.m. on Election Day, with exceptions for individuals in the Safe at Home program and military/overseas citizens. Learn more on our Absentee Voting page.

In Cerro Gordo County, the absentee board will meet on Election Day to count the absentee ballots. They may also meet the day before to review absentee voters' affidavits.

Election Day

Yes. All 23 polling places in Cerro Gordo County meet federal and state requirements for accessibility.

Yes. If you need assistance filling out your ballot ask a poll worker for help. A team of one republican and one democrat will come over and help you mark your ballot. Also available in each polling location is a ballot marking device that will read you all of the choices and then print out your marked ballot.

Yes. Iowa law allows for Election Day registration if you are able to provide proof of identification (i.e. valid photo ID) and proof of residency (i.e. utility bill with your name on it if your ID has an outdated address on it). If you are unable to provide one or both of these you are allowed to bring someone with you to attest that you have the right to vote.

Yes. If you have not returned your absentee ballot you may go to your polling place on Election Day and vote a regular ballot.

Beginning January 1, 2019, Iowa voters will be required to show a driver’s license, non-driver’s ID, passport, military ID, veterans ID, Tribal ID or Voter ID Card at the polls before they vote. Voters, starting in 2019, without an ID may cast a provisional ballot or have another registered voter attest to their identity.

Yes. While it is recommended that you update your information prior to Election Day to speed things up at the polls, you may wait and do so on Election Day. If you are updating your address just make sure you are going to the polling place for your new address. When updating your address you will now need to provide proof of identity and proof of residency.

Yes. If you are unable to go inside the polling place a team of election workers will be sent out to your car to help you vote.

Yes. When you go to vote, a poll worker will verify with the auditor’s office that your absentee ballot has not been returned. If it is confirmed that the auditor’s office has not received a ballot from you then you will be given a new ballot to vote there.

No. Iowa law prohibits a person from revealing how another person voted.

Starting in January of 2019 you will be required to show identification. If you need to register to vote on Election Day, you must bring proof of identification and proof of residency.

You will need to sign the form, swearing or affirming that:

- You are registered to vote in Cerro Gordo County

- You live in the precinct where you are voting

- You live at the address illustrated on the Voter's Declaration of Eligibility form

- You have not and will not vote in any other precinct at this election

Starting in 2019, if you do not have your ID with you, you may either cast a provisional ballot or have another registered voter attest to your identity. Learn more about provisional ballots and attesting on our Voter ID page.

If you don't have an Iowa driver's license or non-operator ID, you may use one of these forms of ID:

- Out-of-state Driver's License or Non-operator's ID

- U.S. Passport

- U.S. Military ID or Veteran's ID

- ID card issued by an employer

- Student ID issued by Iowa high school or college

- Tribal ID card/document

The above IDs must display the voter's photo and an expiration date that is unexpired.

If your photo ID does not contain your current address, you may use another document to prove where you live. Proof of residence must include name and current address and be current within 45 days; may be in electronic format or on paper. The following are acceptable proofs of residence:

- Residential lease

- Utility bill (including a cell phone bill)

- Bank statement

- Paycheck

- Government check

- Other government document

- Property tax statement (current within 45 days of final payment date)

For a student at an Iowa community college or public university, "other government documents" that can be used to prove residency in the precinct include:

- A printed page from an online student directory

- A printed page from an online college or university billing

- A copy of the residence hall contract

The above forms must be current and must list the student's name and local address.

For a student at a private college, you may use a housing contract to meet the definition of a "residential lease." The contract must:

- Be effective for the current semester or term

- List the student's name

- Provide the building name where the student lives and a room number, if applicable

So long as you are in line to vote at the time the polls close you will be allowed to vote.

If a voter’s eligibility is in question on Election Day they are allowed to cast a provisional ballot. After the voter marks their ballot and returns it to the poll worker, the voter is required to provide the necessary identification or documentation at the polling place before it closes or provide it at the Auditor’s Office by noon on the following Monday. If the canvass will be held earlier than the following Monday, the identification must be provided before the canvass.

If it is determined that you do have the right to vote in the precinct in which you voted, your ballot will then be counted and included in the final vote total.

Cerro Gordo County uses a computerized election register to validate each voter. Once a precinct official determines the voter is eligible to cast a ballot, the system will print a Voter's Declaration of Eligibility form.

Voters in each precinct will cast a paper ballot that will be counted by ballot scanners. Absentee ballots will be counted by a high speed ballot scanner.

You will exchange the completed and signed Voter's Declaration of Eligibility form for a ballot and be directed to a voting booth to mark the ballot.

The final step will be for you to insert your voted ballot into the ballot scanner to be counted.

Election results from absentee ballots will be released shortly after the polls close on Election Day. Results from the polling places will be accumulated as precincts report on election night.

Provisional ballots will be reviewed and determined by the Absentee and Special Voters Precinct Board (ASVP Board) within a week of Election Day. The ASVP Board is composed of precinct officials appointed by the Democratic and Republican Parties, and by the County Auditor.

Election night results are unofficial. They do not include valid provisional ballots and valid absentee ballots received after Election Day. Official election results will be certified at the election canvass.

The computerized election register offers a voter the option of scanning a driver's license or registered voter card as a fast and more efficient check-in method, which reduces the potential for human error and streamlines the process.

General Information

Yes. If you make a mistake on an absentee ballot mark your return envelope “Spoiled” and return it to the Auditor’s office either by mail or in person. If you return it by mail contact the Auditor’s office to be sent a new one.

On Election Day if you make a mistake on your ballot, return it to the poll worker to receive a new one. You are allowed up to three ballots so don’t make too many mistakes!

Yes. For each race on the ballot, a line is provided for you to write-in the name of someone for whom you wish to vote for. Make sure you color in the oval!

Yes and No. In Iowa, you must be a member of a political party (currently: Republican and Democratic) to vote in a primary election. However, anyone* can change parties on Election Day and vote. For independents to vote they must declare a political party.

*Precinct election officials may not change political parties within 30 days of an election.

No. You can vote for as much or as little as you would like; it’s all up to you!

Iowa law requires a test of the ballot scanners prior to the election. A group of test ballots for the upcoming election is marked and used to confirm that the ballot scanners are correctly programmed in synchronization with the printed ballots, and that they correctly read the test ballots.

Fill in the voting target next to your choice, using a black pen.

No. If you have already returned your absentee ballot to the Auditor’s office you may not request a new ballot if you have changed your mind on who you wish to vote for.

It depends on the election. In primary elections, you can only vote for candidates from the party to which you belong. In general elections, you are free to vote for anyone you like, regardless of their party affiliation.

Yes. The ballot scanners meet guidelines adopted by the U.S. Election Assistance Commission and have been certified for use by the Iowa Board of Examiners.

Registered voters who do not have an Iowa driver’s license or non-operator’s ID were issued a voter ID card. Voter ID cards must be signed before going to the polls. The new voter ID card will contain a PIN number that will be used for voting purposes. If you should have a voter ID card and do not, please contact our office to have one sent to you.

Starting in 2019, voters must provide an ID when going to vote. Voters who do not have ID will be allowed to either cast a provisional ballot or have another registered voter attest to their identification. Learn more about provisional ballots and attesting on our Voter ID page.

There are 6 approved types of identification that may be used:

- an Iowa Driver’s License or Non-Operator ID

- a Voter ID issued by the Secretary of State or the Auditor’s Office

- a current US Passport

- a US Military ID

- a US Veteran’s ID

- a Tribal ID

Cerro Gordo County Auditor’s Office

220 N. Washington Ave.

Mason City, IA 50401

641-421-3028

Where you vote is determined by where you live and you must vote in the precinct to which you are assigned for your ballot to be counted. To find your polling place please visit the Polling Places page on our website.

Registration

To find out if you are registered or if you need to update your registration, call the County Auditor's office at 641-421-3027 or inquire with the Secretary of State's online site.

No. All updates to voter registration must be made in writing or online through the Iowa DOT if you have an Iowa driver’s license.

Yes. Any eligible voter in Iowa may register to vote. Because many of those who are homeless have a nontraditional address they just need to provide an address or description of where they sleep the most, wherever that may be.

Those with a prior felony conviction are only permitted to vote if their voting rights have been restored by the Governor, including through Executive Order. For more information about restoration of rights, contact the Governor’s office or visit the voter registration page on our website.

Yes. If you moved to a different county in Iowa, you will need to register in your new county. If you moved within the same county, you may update your registration with the County Auditor prior to the election or at your new polling place on Election Day. Updating your address on Election Day will take more time. Also, you will need to provide proof of identity and residence, if you have moved to a different precinct. A voter registration form is also used to change your name or address. Complete the form and return it to the County Auditor's office. A new card will be mailed to you.

No. You would only need to re-register if your information has changed and you need to update it.

There are several ways in which to register to vote. The Iowa Voter Registration Form is available at various locations including this website. You may call the Auditor’s Office 421-3041 to have a voter registration form mailed to you or you may pick one up at the Auditor’s Office. Once the Auditor's Office receives and processes your voter registration, you will receive notice that you are registered.

If you have moved recently and need to update your address for voting, all you have to do is fill out a new voter registration form and submit it to the Auditor’s office. If you do not update your address after a move through a new voter registration form and do not vote in the next general election, you will be marked inactive (inactive voters may still vote with proper ID). Registration will be canceled if two more general elections pass with no voter activity.

If you notice a mistake on your voter card please contact the Auditor’s Office and/or submit a new registration form to correct your information.

Iowa does not recognize an “independent” party. Instead, “No Party” is used to indicate a lack of affiliation with a political party.

The name of the voter who is preregistered will appear in the precinct election register on Election Day.

To register to vote you must be a citizen of the United States, a resident of Iowa, at least 17 years old, have not been convicted of a felony (or have had your rights restored), not currently judged by a court to be "incompetent to vote," and you must have given up your right to vote in any other place. However, you must be 18 years old in order to vote.

If you preregister to vote, you do not have to show proof of identity and current residency in your precinct. Refer to "Important Dates" under the specific election to determine the preregistration deadline.

When registering to vote at the polls on Election Day, you will have to show proof of identity and current residency in your precinct, so you should be aware the process will take more time.

County Assessor

Our office keeps a record of the mailing address where the owner requested assessment notices and tax statements be sent, however we are not able to provide any other contact information (such as phone numbers or email addresses).

If you know the address or parcel number of the property, you may use our Beacon Property Search page to look up sales information. Simply enter the information in the appropriate search box, and then hit “Search”. The sales information will be located in the “Sales” section of the property record page. Sales that occurred before 1995 will not display because they occurred before the city went to a computerized system, however you may contact our office and we would be happy to find that information on our paper property records.

If you know the address the property, you may use our Beacon Property Search page to look up the parcel number. Simply enter the address in the address search box, and then hit “Search”. The parcel number will be located in the “Summary” section of the property record page.

Our office provides a map of all property lines within the county. Simply go to our Beacon Property Search page and enter your address. Once your property has loaded, click the “Map” button at the top of the page. In order to see your lot lines, you will need to have a few layers turned on. Look to the “Layers” list on the left side of the page, and make sure the box next to “Parcels” is checked. In order to see lot dimensions, click the plus sign (+) next to “Annotation” at the top of the “Layers” list, and make sure the boxes next to “Lot Dim 100” and “Lot Dim 400” are checked.

Please be aware that, while our maps are very accurate and will give you a good idea where you lot lines are, they are not the same as a survey. If you are unable to locate you parcel pins by reviewing our map, you may need to hire a licensed land surveyor to locate your property lines for you. Names of licensed surveyors can be found under “surveyors-land” in the Yellow Pages of the phone book. Most licensed surveyors will provide you with an estimate of cost for performing the survey.

If you know the address or parcel number of the property, you may use our Beacon Property Search page to look up who currently owns the property. Simply enter the information in the appropriate search box, and then hit “Search”. The owner information will be located in the “Owner” section of the property record page.

When a lot is platted, pins are placed at all corners of the property. Parcel pins are usually a piece of rebar driven into the ground, and then capped at ground level with a colored plastic cap that includes the name of the surveyor who platted the land. Over time, these pins tend to get pushed underground, but there are several ways to locate them. Review the map on our Beacon Property Search page, and either use a metal detector, or dig at the corners indicated on the map. If you are unable to locate your pins, you will need to hire a licensed land surveyor. Names of licensed surveyors can be found under “surveyors-land” in the Yellow Pages of the phone book. Most licensed surveyors will provide you with an estimate of cost for performing the survey.

Depending on the classification of the property, the assessment is to represent the market value of the property unless otherwise provided by Iowa Code. Residential, agricultural dwellings, commercial, and industrial classed properties are to be assessed at market value. Changes in market value as indicated by research, sales ratio studies and analysis of local conditions as well as economic trends both in and outside the construction industry are used in determining your assessment. Agricultural land and buildings are valued on productivity and net earning capacity.

State law requires all properties to be reassessed every two years. Current law requires the reassessment to occur in odd numbered years. If necessary, assessors may reassess property every year.

Each year, assessed values are subject to a rollback factor determined by the Director of Revenue creating a taxable value. Property tax is calculated by applying a levy rate to the taxable value. Levy rates and rollbacks change from year to year therefore adjusting the amount of property tax.

If you disagree with the assessment of a property, you have two basic options. One option is to have an informal review with the assessor’s office. If an agreement can be reached between April 2 through April 25, a signed document will change the assessment to the mutually agreed to value or classification. The second option is to file a formal appeal with the Board of Review between April 2 and April 30. Appeal forms are available on the Board of Review page.

There are a number of different taxing districts in a jurisdiction, each with a different levy rate. Each year the county auditor determines for that district a levy rate that will yield enough money to fund the different entities in that district. The entities include local schools, counties, cities, townships, community colleges, local assessors, and others. Since more than one taxing authority is calculating a tax rate for the property, all the rates are added together, resulting in a single tax levy called a consolidated levy. This consolidated levy is always the result of two or more tax rates established by different government entities.

The rollback rate is a statewide rate set annually for each property class by the Iowa Department of Revenue. More than 20 years ago, residential property values were rising quickly. To help cushion the impact of high inflation, the Legislature passed an assessment limitation law called rollback. Increases in assessed values for residential and agricultural property are subject to this assessment limitation formula. If the statewide increase in values of homes and farms exceeds 3 percent due to revaluation, their values are "rolled back" so that the total increase statewide is 3 percent. Rollback is also available for industrial and commercial property when necessary. This does not mean that the assessment on your home will increase by only 3 percent. The rollback is applied on a class of property, not an individual property. This means that the statewide total taxable value can increase by only 3 percent due to revaluation.

Real estate parcels are annually assigned a property classification by the assessor. This classification is to be consistent with the primary use of the property. There are five classifications of property in Iowa. These classes are agricultural, residential, commercial, and industrial. Classification may not necessarily be the same as the zoning of the property.

Over the years, the term CSR has become a household word among farmland owners and tenants in Iowa. CSR (corn suitability rating) is a soil productivity rating for Iowa soils that ranges from a low of 5 to a high of 100. It was introduced in 1971 by Thomas Fenton from Iowa State University and has gained in popularity ever since. CSR values are often used when figuring farmland indexes such as land values and cash rents. The index has also been correlated to crop yields although part of the intent of the index was to establish a system for equitable tax assessment, a way to level the playing field by measuring a soil’s productivity and not how well the operator was doing yield-wise with the land. All Iowa counties presently use the CSR rating when figuring individual real estate property taxes.

Note: Agricultural Land in Cerro Gordo has been updated with the new Corn Stability Rating (CSR2) map soils and adjustments have been made for tillable/non-tillable ground. CSR2 and land adjustments are mandated by the Iowa Department of Revenue and must be implemented by the 2017 year in all counties.

Market value of a property is an estimate of the price that it would sell for on the open market on January 1st of the year of assessment. This is sometimes referred to as the 'arms-length transaction' or 'willing buyer/willing seller' concept.

Assessment notices are mailed on or before April 1st whenever there is a change in assessment to a taxpayer’s property.

Engineer and Secondary Roads

Snow Fence Program

Please call 641-424-9037 or email cgcengineer@cerrogordo.gov and mention you want to talk about the snow fence program. You can stop out and see us at 17274 Lark Avenue in Mason City too.

The county will pay $1/foot for stacked bales (2 high) running parallel and 200 feet from edge of road.

It is thought the corn will be harvested in the spring, but could be hand harvested in the fall - as long and stalks are not broken.

The county is not applying any value to this method.

We work with our plow operators to pinpoint the areas which give us the most trouble for drifting. Then we negotiate with the landowner/tenant.

The county will either use the Farm Service Agency (FSA) county yield numbers or use the certified yield monitor report for the parcel from the landowner/tenant.

24 rows of corn spaced about 30” apart and 500’ long would be 0.689 acres. Using the 2023 prices of $6.72/bushel and an example of 110 bushels per acre – the price paid would be $509.31.

The County will pay the tenant or landowner based on its FSA reported yield or monitored harvest yield. Price per bushel is determined using the county-wide average cash price on August 1st each year plus $2.00 per bushel for October new corn price. Agreements only go from fall to spring and can be renewed each year.

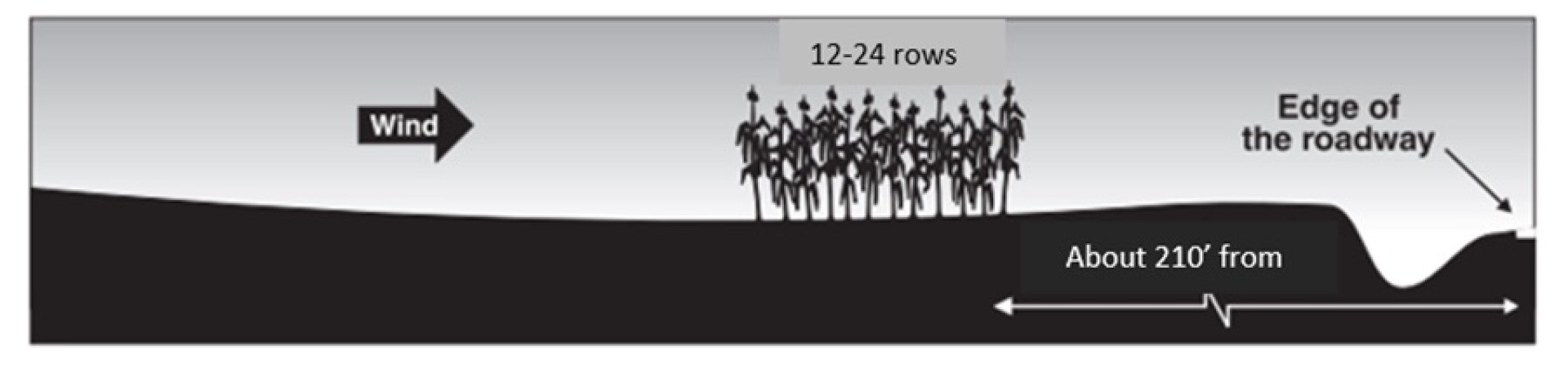

In order for the standing corn ‘fence’ to work, the rows have to run parallel to the road. The first row of corn left standing should be abut 200-210’ from the edge of the road.

Our program would like to have a minimum of 12 rows of corn left and a maximum of 24 rows.

If we can make arrangements with the landowner/tenant, the county will first concentrate on paved roadways affecting a larger number of travelers where drifting is bad. Gravel roadways will be considered if there are especially bad areas of drifting or the number of travelers affected is high. Budget is always a limiting factor.

- Standing corn

The program most desired by the County, leaving 12-24 rows up all winter:

- Pushed up snow

When the ground freezes solid and when enough snow as accumulated, the county, with consent, takes a road grader or snow plow and pushes snow up in a line to act as a fence. This may occur several times in the season.

- Stacked round hay bales

Ideally stacked 2 tiers high.

- Tall silage bags

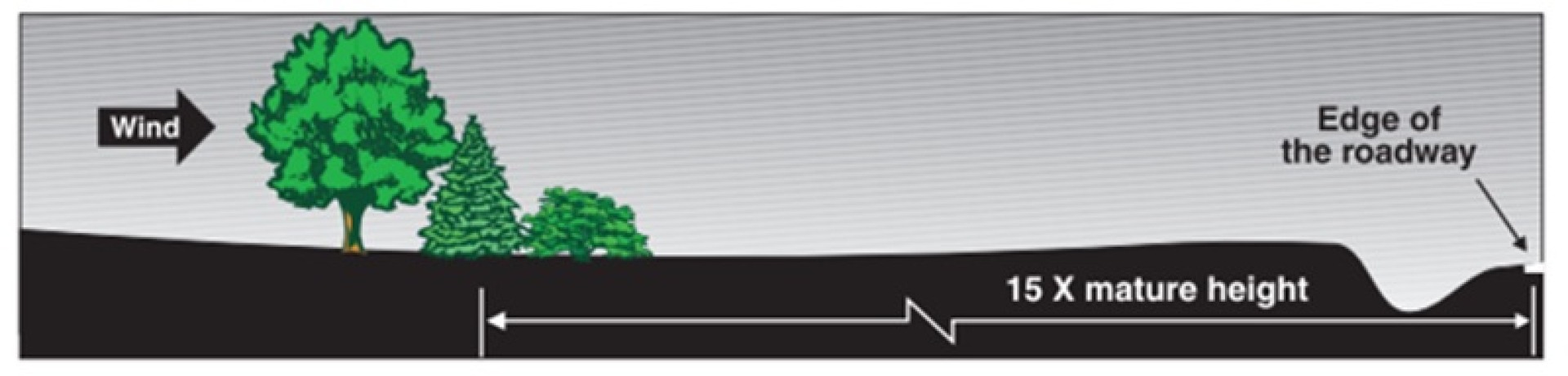

- Living Plants and Trees:

- Plastic Fence

This is the most costly and labor intensive. Due to limited supplies and fund, this is low on the list to be done over other methods.

Planning and Zoning

Board of Adjustment

- Completed application

- $300 filing fee

- Written statement describing the use and aspects listed in the application

- Site plan showing the location of any buildings involved with the use and where the use is planned to happen. (There may be an additional site plan fee for specific uses as listed in the application.)

- Any other materials required for a specific use or requested by our office.

This is a type of permit that only the Board of Adjustment can grant to allow specific types of activity to occur on a property that are listed in Article 20.2 of the county Zoning Ordinance. Depending on the specific details of the requested special use, requirements will be put in place on that use that will mitigate potential impacts from the activity.

Before applying, you should contact our office about the special use and discuss the details with us. We will help you with the requirements and what needs to be submitted with the application.

Please contact us to go over what you would like to do, and we will help you through the process.

By Phone: 641-421-3075

In Person:

Cerro Gordo County Courthouse

220 N Washington Ave.

Mason City, IA 50401

The Board hears requests for special exception outlined under certain standards, requests for variances from the rules of the Zoning Ordinance, unique uses, referred to as a special use, on properties that tend to have bigger impacts on surrounding properties, or appeals to decisions made by the Zoning Administrator. No request is guaranteed to be approved by the Board. Each request is considered on the specific details of the individual request.

Building/Zoning Permits

The permit fee is based on the projected cost of construction. The fee table shows the costs. The fee will not be charged until after your application is reviewed. Permit fees must be paid and the permit issued before you begin construction.

The only way to know for sure is to locate your property pins at each corner of your property. These can be located with a metal detector or special locator. You may need to hire a professional land surveyor to locate the pins for you. We may be able to help you if we have record of existing structures on the property. Sometimes an official property survey may be on record at the Cerro Gordo County Recorder’s Office.

No. It is recommended you call the Cerro Gordo County Assessor’s Office at 641-421-3141 so the change can be accounted for in your property records.

A setback is the closest distance from the structure you would like to build to each property line, or the right-of-way line along streets.

If the sidewalk or driveway is at ground-level, you do not need a zoning permit. However, for a new driveway, you will need a Driveway Permit from the County Engineer’s Office to connect to the public right-of way. You also may need a Driveway Permit for widening a driveway.

Yes. This includes structures that do not have a permanent foundation, sheds on skids, temporary car port canopies, dog kennels, and other similar structures.

You may build on less than 10 acres under certain circumstances. In the A-1 Agricultural District, parcels of less than 10 acres created before March 13, 1990 are considered legal lots. Parcels zoned A-1 and created after March 13, 1990 must be 10 acres or larger in size.

Another exception includes parcels zoned A-2 Agricultural. In the A-2 district, the minimum parcel size is two acres. Normally, these are existing farmsteads that are being severed from surrounding tillable land. Requests to rezone from A-1 to A-2 are heard by the Planning and Zoning Commission, which makes recommendations to the Board of Supervisors.

You may qualify for agricultural exemption if:

- The parcel or group of parcels you want to build on is at least 10 acres in size

- The parcel you want to build on is zoned A-1 Agricultural and the use of the structure is allowed in the zoning district.

- Where you want to build is not in a floodplain

- The property and structure you are building is used for agricultural purposes

- All required approvals from the Public Health Department have been received

Some rules or structures never qualify for agricultural exemptions, including but not limited to:

- A second home on the same parcel

- If you want to build in a floodplain

- A horse stable

- Hobby farms

- If the use of the structure is not allowed in the A-1 Agricultural district or the property is not zoned A-1 Agricultural

You need to turn in an application to the Planning and Zoning office to determine whether a structure qualifies for agricultural exemption. No permit fee is required if the structure qualifies.

You can check the floodplain map or contact us to find out if the location for a structure you want to build is in a floodplain.

Before any construction or digging can occur in a floodplain as determined by FEMA, the project must be applied for and reviewed by the Iowa DNR. You also need to receive a Floodplain Development Permit from our office before any work can be done.

Feel free to contact us:

Phone: 641-421-3075

Address:

Cerro Gordo County Courthouse

220 N Washington Ave.

Mason City, IA 50401

You can find the district rules and general zoning rules in the Zoning Ordinance. Please contact us with any questions you may have:

By Phone: (641) 421-3075

In Person:

Cerro Gordo County Courthouse

220 N Washington Ave.

Mason City, IA 50401

Anytime you want to build, reconstruct, move, add on to, or alter any structure on your property, you need a Zoning Permit.

Please contact us to look up the zoning of your property.

Phone: (641) 421-3075

Address:

Cerro Gordo County Courthouse

220 N Washington Ave.

Mason City, IA 50401

Docks

No. Dock assignments are in high demand, so we can only accommodate one assignment per assignee when a hoist location opens up.

Due to the high demand for assignments, you should expect a minimum of 3 years before we get to your name on the waiting list.

Spots are assigned according to state law and the dock policy. Both require assignments on the basis of the following priority:

- Priority 1: own a house in a South Shore subdivision

- Priority 2: own a house in Cerro Gordo County

- Priority 3: Iowa residents.

We first work through the Priority 1 group, then Priority 2, and then Priority 3. Otherwise, the spots are offered based on time of request with older requests being offered spots first.

Every year we have some administrative costs. There is a $50 per hoist fee for each dock assignee. There is also a $250 administrative fee shared among the assignees of each dock.

Dock assignees are also responsible for the cost to maintain the dock and public approach and other costs, including setting it up and taking it down each season, off-season storage, maintenance and other costs associated with the dock. Dock assignees must agree to the equitable sharing of costs with each other. There is a dock contact person for each dock that organizes the costs and operation of the dock.

Hoist locations open up when existing assignees voluntarily notify us they would like to give up the spot, non-use of an assignment, or the dock rules are violated.

- Bayberry Avenue, Ventura Heights

- 242nd Street, Ventura Heights

- 240th Street, Dodges Point Park

- Pascal Street, PM Park

- Leroy Street, PM Park

- Lakeview Drive, Oakwood Park

- Ash Street, Oakwood Park

- Linden Street, Oakwood Park

- Oak Street, Oakwood Park

- Elm Street, Oakwood Park

- Hill Street, Oakwood Park

- Sycamore Street, Oakwood Park

- Walnut Street, Oakwood Park

- Hackberry Street, Oakwood Park

- Maple Street, Oakwood Park

Dock assignments are in high demand. At this time, you will have to be put on the dock waiting list until an assignment opens up.

To be placed on the waiting list, please include the following information:

- Which dock(s) you want to be on the waiting list for

- Name

- Address of property owned on the South Shore or in Cerro Gordo County

- Mailing Address

- Phone Number

- E-Mail address, if possible

- Any other information to assist us in contacting you, such as an alternate phone number

Floodplains

Check to see floodplains in Cerro Gordo County.

It depends. Anytime you want to build or dig in a 100-year floodplain as determined by the Federal Emergency Management Agency (FEMA), review of the work is required by the Iowa DNR before any work is done. The DNR has what is called a Joint Application for any proposed work in a floodplain. This includes building structures as small as a shed or deck, doing any digging or excavation, or rebuilding an aging structure in the exact same location.

Once a DNR review has been conducts, a local floodplain permit is also required for any work in the floodplain. We cannot approve any development in a floodplain until the DNR has reviewed the proposed work.

P&Z Definitions

Land that has a 1% chance of flooding in any given year.

A county employee authorized by the Board of Supervisors to enforce the rules of the county’s Zoning and Subdivision Ordinances.

A legal document prepared by a professional land surveyor mapping the exact dimensions and details of a property.

These are uses, that due to their potential impacts, are considered following a public hearing before the Board of Adjustment (BoA). The BoA may establish conditions that the use must meet so it is compatible with its surroundings.

The closest distance from the structure you would like to build to each property line, or the right-of-way line along streets.

Land that has been dedicated to Cerro Gordo County, the state, or the federal government and the public for circulation and services. Most of the time, a right-of-way is a public street and the adjacent land or an alley.

Duties and responsibilities performed like a hybrid between the court of law and a town hall meeting.

Your property divided by official property lines.

Farm homes, farm structures, cultivating the soil to raise crops, raising livestock for food.

Responsibility to review requests and make recommendations. Does not make a final decision.

Planning and Zoning Commission

Please contact us with any questions regarding rezonings, subdivisions, or vacating a platted street:

By Phone: 641-421-3075

In Person:

Cerro Gordo County Courthouse

220 N Washington Ave.

Mason City, IA 50401

Rural Address Markers

Yes. Not keeping a 911 sign in good condition and refusing to have it replaced can result in up to a $100 penalty per day until it is corrected.

To order a new sign or post, you can contact us:

- By Phone: (641) 421-3075

- In Person: Cerro Godro County Courthouse; 220 N Washington Avenue; Mason City, IA 50401

If it is the first address sign for a newly addressed property, the County will supply the sign and post at no cost. For replacements, a new sign costs $45. A new post costs $25. Both together cost $60.

Please contact the Engineer's Office at (641) 424-9037 to report the incident as soon as possible after it occurs.

Generally, it should be placed to the right of your driveway along the right-of-way line of the street. If that is not practical, finding an alternative location is okay. It needs to be easily seen and legible from the road.

Signs

Most signs must have a Sign Permit from our office:

- Chapter 19.6 of the Zoning Ordinance regulates the placement of signs

- Application

- Submit completed application by email, mail an application to our office at the address below, or turn in an application directly to our office.

Questions? Call us at 641-421-3075 or stop by our office during business hours:

Cerro Gordo County Courthouse

220 N. Washington Ave.

Mason City, IA 50401

Please contact us with any questions regarding signs:

By Phone: 641-421-3075

In Person

Cerro Gordo County Courthouse

220 N Washington Ave.

Mason City, IA 50401

Recorder

Passports are handled in the Treasurer’s Office: 641-421-3127.

Real Estate Records

No, the Recorder’s Office does not record or store abstracts. Usually, the abstract is given to the property owner to keep in a safe place at the time of purchasing the property.

No. Wills are generally filed at the Clerk of Court’s office:

220 N. Washington Ave. (2nd floor)

Mason City, IA 50401

Phone: 641-424-6431

The Recorder’s Office cannot assist property owners in preparing documents. It is wise to contact an attorney for advice on adding or removing names to property records.

The County Auditor’s Office can update the mailing address where your tax bill is mailed. Please call 641-421-3028.

This calculation is based on a $1.60 tax per thousand and the first $500 is exempt.

Cerro Gordo Abstract Company

305 N. Federal Ave # 2

Mason City, IA 50401

Phone: 641-423-1145

Vital Statistics

If the death occurred between 1954 and the present you can obtain the record at any County Recorder’s Office in the State of Iowa. Prior to 1954, please contact the county office where the death occurred.

If the marriage occurred between 1954 and the present you can obtain the record at any County Recorder’s Office in the State of Iowa. Prior to 1954, please contact the county office where the marriage application was filed.

Cerro Gordo County Recorder

220 N. Washington Ave.

Mason City, IA 50401

Phone: 641-421-3056

Please call with any questions.

There is no formal “registration” of Officiants in Iowa. You are authorized to solemnize marriage ceremonies in Iowa if you are:

- An Iowa judge, magistrate, or associate judge serving on the Iowa supreme court, court of appeals, or district court; or

- An individual ordained or designated as a leader of the person’s religious faith, regardless of the state of residence or service (595.10)

There is no fee to get married at the courthouse in front of a Magistrate Judge. Please contact the Clerk of Court to set up an appointment by calling 641-424-6431.

No. We will record your military documents at no fee and provide certified copies at no fee.

Once it is picked up from the Recorder’s Office, it is good until you are married. The Recorder’s Office will hold the paperwork for six months. If not picked up before the expiration of six months, it will expire and be unusable.

- Both parties need a current government-issued photo ID (driver’s license) or passport.

- $35 fee, cash or credit card only accepted (3% fee applies for credit card).

- One witness,18 years of age or older. They must know both parties.

$15 per certified copy. Cash, checks, and credit cards are accepted (fee applies to credit card transactions).

Military discharge records are not available to anyone who cannot prove they are entitled to the record. Identification must be given to prover entitlement (unless the record is 62 years or older).

Divorce records are court actions, so they are kept at the Clerk of Court: 641-424-6431.

Entitlement to a record includes the person named on the record, or the person’s spouse, children, legal parents, grandparents, grandchildren, siblings, or legal representative or guardian (legal guardians and representatives must provide proof of guardianship or representation). Applicant must be 18 years old or older.

Sheriff

We cannot provide criminal history information to the public. The Division of Criminal Investigation (DCI) is able to run the queries for a fee: https://dps.iowa.gov/divisions-iowa-department-public-safety/iowa-division-criminal-investigation/criminal-history-record-check-information.

You are able see some case information when you search by name at Iowa Courts online.

We are unable to tell you if you have a warrant. If you believe you have a warrant, you can turn yourself in at a law enforcement facility. If there is a bond, you can post the bond and be released. Otherwise you will see the judge.

There is a $5 charge (cash or check only). A report will only be released to those involved in the case or insurance companies.

Your insurance company can request one directly by sending check and request to:

Cerro Gordo County Sheriff’s Office

17262 Lark Ave.

Mason city, IA 50401

If you were given the case number they should include that on the request.

If the accident happened in Mason City limits or if another agency took the report (i.e. state patrol, Clear Lake PD) you will need to contact their office.

- Mason City Police Records: 641-421-3694

- Clear Lake Police: 641-357-2186

- Iowa State Patrol: 641-424-3625

- Rockwell Police Dept: 641-822-3690

Ticket fines must be paid to the Cerro Gordo County Clerk of Court. You can pay online or call the clerk of court at 641-424-6431.

Complete this form to notify the dispatch center. Please remember we check properties as we are able. We cannot guarantee the safety of your property while you are absent.

Please see the following resource from the Iowa DOT:

- Iowa: 800-288-1047 or Road Conditions: Iowa 511

- Minnesota: 800-542-0220 or Road Conditions: Minnesota 511

We only pick up stray or lost dogs – no other animals. We contract with a service so the dog must be confined (on leash, in fence, or in building) before they will come pick up. Since we have a service that will pick the dog up, their response time may not be immediate. Please complete this form or call 641-421-3000 for dispatch.

Treasurer

Motor Vehicles

No. The Treasurer does not process Driver's Licenses in Cerro Gordo County. Please visit the Iowa DOT website.

Yes, but the registration will be mailed to the owner of the record unless you bring in the renewal notice, an old registration or have the owner call and give permission.

Yes. You can return your currently registered vehicle plates and have it coded as "Stored" status and pay no further registration or penalty fees until you are ready to resume driving it.

A full year's registration fee will be charged when taking the vehicle out of storage, so it is only beneficial if the vehicle remains stored for over a year.

There is no charge for a parking permit or plates. It does require a letter from your physician indicating a temporary or permanent disability.

There is a $3 charge for a lost registration and sticker.

You will need to bring in the following items:

- Certificate of Title (if available).If your out of state title is unavailable due to lienholder retention—you will need to bring in your most current registration document for the vehicle.

- Iowa DL/ID or previous state DL/ID and Social Security #

- Application for Certificate of Title and/or Registration (IA DOT form #411007), completed and signed by all owners.

- Damage Disclosure Statement (IA DOT form 411108), only if vehicle is 7 years old or newer.

- Odometer reading only if vehicle is 9 years old or newer.Any vehicle over 9 years old is exempt from odometer disclosure.

If the vehicle is a lease, you can contact our office for further information and help determining the documents you will need to transfer and register the vehicle in Iowa.

If a vehicle is sold or junked, you may be eligible for a refund of registration fees. A refund may be applied for at the county treasurer’s office in any county by presenting plates and a current registration. Refunds will be mailed from the State of Iowa and will take approximately 4-6 weeks.

If a vehicle is traded in for a different vehicle, we can apply the credit towards the newly acquired vehicle.

Yes, you DO need to remove their name from the certificate title. This can be done at no charge. Required documentation can vary, for more information please contact our office at 641-421-3127.

You will need to bring the following items:

- Certificate of Title with the appropriate signatures and printed names of the seller(s) and buyer(s).

- Application for Certificate of Title and/or Registration (IA DOT form #411007), completed and signed by all buyers.

- Damage Disclosure Statement (IA DOT form 411108), only if vehicle is 7 years old or newer.

- Odometer reading only if vehicle is a 2011 or newer. Vehicles years 2010 and older are exempt.

- Bill of Sale from the dealer.

You will need to bring the following items:

- Certificate of Title with the appropriate signatures and printed names of the seller(s) and buyer(s).

- Application for Certificate of Title and/or Registration (IA DOT form #411007), completed and signed by all buyers.

- Damage Disclosure Statement (IA DOT form 411108), only if vehicle is 7 years old or newer.

- Odometer reading only if vehicle is a 2011 or newer. Any vehicle which is 2010 or older is exempt from odometer disclosure.

- Bill of Sale is required as of 1/1/2020. Must be signed by the seller.

Trailers with an empty weight of 2000 pounds or less cannot be titled but will have a registration. The current registration, signed at the bottom by the buyer and seller, will be used to transfer ownership.

Trailers with an empty weight of 2000 pounds or more will be titled, and transferred similarly to a motor vehicle.

Forms are available in our office, in the common forms and applications section of our website or https://iowadot.seamlessdocs.com/sc/vehicles

Passports

- Application

- Form DS-11 - New Application

- Form DS-82 - Renewal Application

One of each of the following citizenship and identification items are necessary to apply for a passport:

- Citizenship Evidence:

- Fully-valid, undamaged U.S. Passport (may be expired)

- Certified U.S. birth certificate that meets the following requirements:

- issued by the city, county or state of birth

- lists your full name, date of birth and place of birth

- Lists your parent(s)' full names

- Has the date filed with the registrar's office (must be within one year of birth)

- Has the registrar's signature

- Has the seal of the issuing authority

- Consular Report of Birth Abroad or Certification of Birth

- Certificate of Naturalization

- Certificate of Citizenship

- Identification Document:

- Fully-valid, undamaged U.S. passport (may be expired)

- Fully-valid U.S. driver's license

- Certificate of Naturalization or Citizenship

- Government employee ID (city, county, state or federal)

- U.S. military ID or military dependent ID

- Valid foreign passport

- Matricula Consular (Mexican Consular Identification, commonly used by the parent of a U.S. citizen child applicant)

Please note: If you present an out-of-state ID, you must present an additional ID.

Passport Book

- Applicants 16 years of age and older: $130

- Applicants under 16 years of age: $100

Passport Card

- Applicants 16 years of age and older: $30

- Applicants under 16 years of age: $15

Payment options

- A check or money order/cashier’s check is required for the fees that we send, with completed applications, to U.S. Department of State.

- Fees retained by our office can be in the form of cash, check, debit, or credit card.

Our office processes photographs for $10 or you can bring a photo, but it must meet the passport agency specifications.

We also recommend wearing dark colored clothing that is also non-camouflage types of clothing.

No.

No. You are only able to pre-fill and print your application forms, but you cannot apply for a passport online.

All passport applications must be submitted through a certified passport acceptance facility.

Passports obtained at 16 years of age and older:10 years

Passports obtained under 16 years of age: 5 years

Visit the U.S. Department of State Website.

Property Tax

Because we run on a fiscal year and not a calendar year:

- First half taxes are September 1st, delinquent October 1

- Second half taxes are due March 1st, delinquent April 1

If a customer wants to pay the full year taxes at one time, they will typically pay the whole year in September.

You may pay by any of the following convenient ways:

- Through the mail. Postmark must be by September 30 for the first half payment and March 31 for the second half payment to avoid penalty.

- In our office from 8:00 a.m. to 4:30 p.m.

- Online through the Iowa Treasurer's website. You must have the 5-digit receipt number located on your tax statement available.

Taxes are billed every fall and statements typically go out in the mail in mid-late August.

Your receipt number is printed on your statement.

Your payment history can be found on your annual statements and also online through the Iowa Treasurers website. You may need to contact our office at at 641-421-3127 for assistance.

Almost all credits are applied for through the Assessor's Office. To apply for a homestead credit, please contact the City Assessor for all properties located within the Mason City limits. For all other properties contact the County Assessor.

The only credit handled by the Treasurer’s Office is the Disabled/Senior Credit. Please visit the Property Tax Credits page for more information.

A 1.5% penalty is assessed per month after the due date.

The tax sale is the sale of any unpaid property taxes within the county as of the first part of June. The tax sale is held electronically on the third Monday in June.

Veteran Affairs

We assist veterans, and their dependents to secure county, state and federal benefits allowable under the law.

Find out if you can get VA health care as a veteran by visiting the U.S. Department of Veterans Affairs website.

A gathering of financial information by which VA determines your priority group for enrollment, and whether you are required to make co-payments.

Everyone enrolled in VA Healthcare has a primary care doctor assigned to them. You need to contact the VA clinic you are seen in, and request items, or referrals from your VA primary care doctor.

You must be enrolled into the VA health care system to use. The Department of Veteran's Affairs (VA) may authorize a non-VA health care facility to provide necessary medical care services when such services are not feasibly available at a VA health care facility, or VA determines that such services can be obtained outside the VA more economically, or more appropriately due to geographic inaccessibility or other hardships.

Contact the National Archives Personnel Record Center, St Louis. Learn more on the National Archives website.

No. Although you can order replacement dog tags from a variety of online venders. Read more at: https://veteran.com/replacement-dog-tags/

Disability compensation is a monthly monetary benefit paid to Veterans who are determined by the VA to be disabled by an injury, or illness that was incurred, or aggravated during active military service. You are rating by percentages 0% to 100% ratings can be granted. Contact your local VA rep for assistance or visit www.va.gov/disability/

C&P Exam (short for “Compensation and Pension”) is an exam performed by a VA salaried or contracted physician to document the current severity of a condition that is being considered for VA Disability and DoD Disability.

- QTC (Quality Timeliness Customer Service): 1-800-682-9701

-

VES (Veterans Evaluation Services): 1-877-637-8387

-

LHI (Logistics Health, Incorporated): 1-866-933-8387

Visit the U.S. Department of Veteran Affairs website to learn more about CHAMPVA.

The Veterans Pension program provides monthly tax-free payments to wartime Veterans who meet certain age or disability requirements, and who have income and net worth within certain limits. Learn more by visiting https://www.va.gov/pension/. Contact your local county veteran service officer for assistance.

Survivors Pension, formerly referred to as Death Pension, is a tax-free benefit payable to a low-income, un-remarried surviving spouse or unmarried helpless child(ren) of a deceased Veteran with wartime service. Must meet certain age or disability requirements, and who have income and net worth within certain limits. Learn more by visiting https://www.va.gov/pension/survivors-pension/. Contact your local county veteran service officer for assistance.

The Home Base Iowa program helps to assist veterans and their spouses in finding employment.

Visit the Iowa Department of Veterans Affairs website to find more information.

Learn more about their services by visiting: https://dva.iowa.gov/iowa-veterans-home

Find more information and applications at: https://dva.iowa.gov/iowa-veterans-cemetery/eligibility-burial

Visit the Iowa Department of Veterans Affairs website to learn about State of Iowa Veteran benefits.

Visit the U.S. Department of Veterans Affairs website.